Propensity to Defraud key benefits

Drive Down the Cost of Tackling Fraud

For MGAs and Insurers who want to improve their loss ratio through reduced claims exposure, Propensity to Defraud is a Machine Learning Predictive service accessed via an enrichment call.

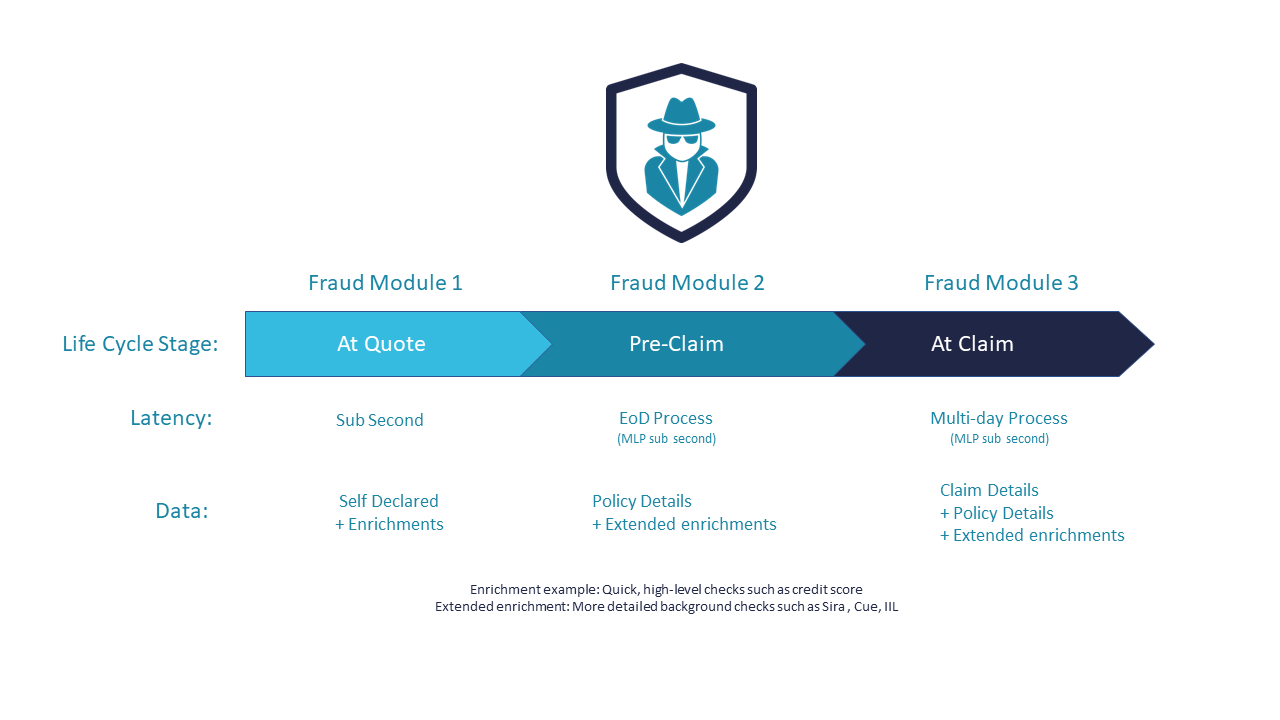

The model can be harnessed at 3 key stages of a policy’s lifecycle.

- Module 1. At Quote

- Module 2. Pre Claim

- Module 3. At Claim

This provides the ability to:

- Utilise valuable machine learning insights on risk selection at the point of quote.

- Detect potential application frauds within recently converted policies.

- Assess the legitimacy of claims as and when they arise.

Detecting fraud is costly, resource intensive and time consuming due to the manual checks that are often required. Having the capability to be proactively alerted to potential insurance fraud allows anti-fraud teams to focus their efforts on the higher risk policies first – increasing the teams productivity and reducing the cost of tackling fraud – which ultimately leads to a more profitable business.

Furthermore, by providing in-house historical data insurers can further enhance predictive accuracy by using the enhanced propensity to defraud model.

Our Modules – Explained