Overview

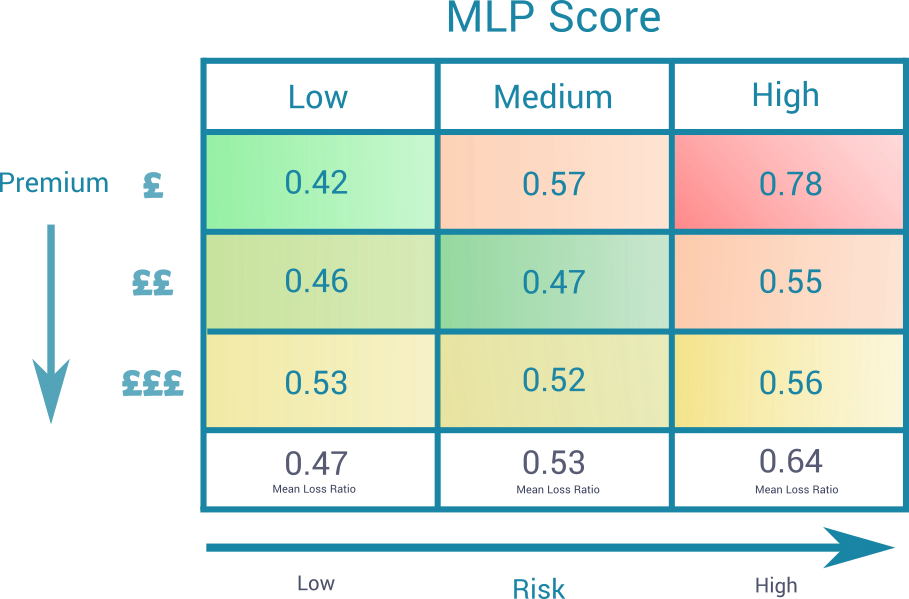

MLP Score is a cutting edge enrichment service designed to give insurers, MGAs and delegated authority underwriters the insight needed to fairly, accurately and profitably price a risk.

Available at point of quote, MLP Score returns a risk score on a risk by risk basis via its machine learning model that is constantly retrained with the latest market data. MLP’s unique access to 3-5 million quote records per day ensures that clients are provided with the broadest, most up to date and relevant market insights, this provides the ability to price a policy with confidence by having a proven and effective means of assessing risk.

Ultimately, MLP Score has shown to significantly improve the quality and profitability of loss ratios.

Overview

Propensity to Claim addresses the real world needs of today’s insurers, MGAs and delegated authority underwriters by assisting you to manage the quality and profitability of your loss ratios. Insurers can support their actuarial modelling via an enrichment API call.

The propensity to claim model provides valuable machine learning insights on risk selection, giving insurers an extra degree of confidence.

By providing in-house historical data, insurers can further enhance predictive accuracy by using the enhanced propensity to claim model.

A Fresh Approach to Running a Profitable Book

Are you pricing the right risks at the right price?

A powerful enrichment service available at point of quote:

• Simple to set up

• Prove value prior to purchase through a Retro exercise

• Payment is based on your bottom line improvement

• Get the insight needed to ensure profitability in all segments